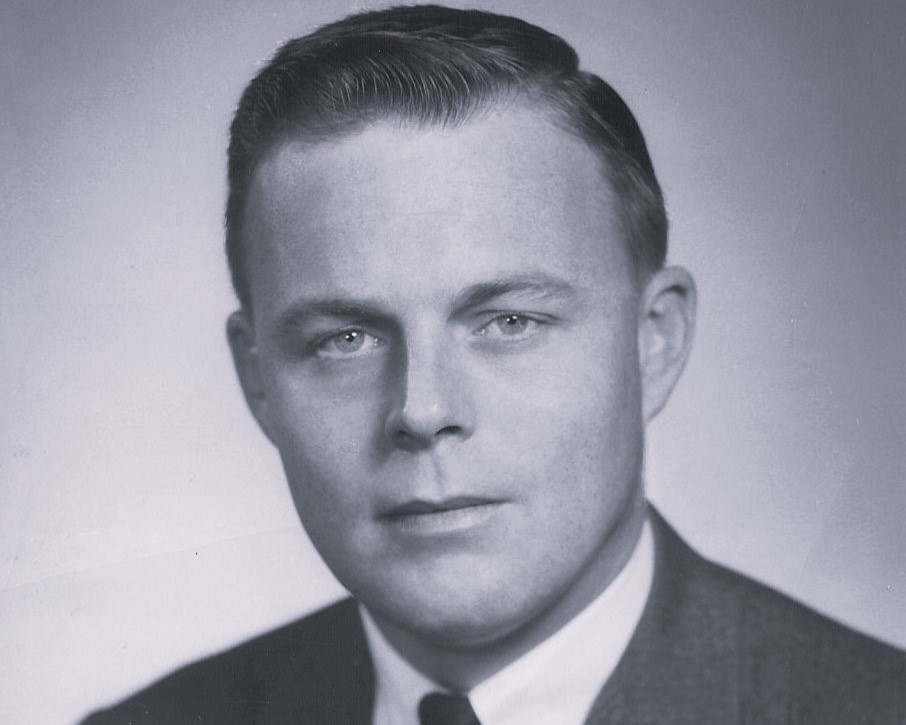

Blake Eagle

The Godfather of Institutional Real Estate

Celebrating a Visionary

&

the Blake Eagle Center for Real Assets

Blake Eagle's visionary leadership was instrumental in shaping the real estate sector into a cornerstone of institutional investment. His groundbreaking work not only established real estate as a crucial asset class but also championed the importance of research and data transparency within the industry. Known for his dedication to advancing best practices, Blake's influence extended beyond his professional achievements to mentor future leaders and drive industry-wide improvements in transparency and data integrity.

Today, the RPII Real Assets Education Foundation honors Blake’s enduring legacy through the Blake Eagle Center for Real Assets. The Center embodies his commitment to excellence by providing unparalleled leadership and support to the real assets community. It advances best-in-class practices in institutional investment management, promotes cutting-edge research, and fosters good governance and transparency in performance reporting—principles that Blake championed throughout his illustrious career. By continuing his mission, the Blake Eagle Center ensures that his pioneering spirit and dedication to the field live on, guiding the future of real assets investment.

From Vision to Legacy

Blake Eagle and the Dawn of Institutional Real Estate

A Chance Encounter with Destiny

Blake Eagle’s entry into real estate was marked by a blend of fortune and chance. After graduating from the University of Washington in 1956 with a B.A. in Business Administration, Blake began his career in diverse roles — from serving as a Second Lieutenant in the U.S. Army to working in sales at Ford Motor Company. It was through a fortuitous recruitment by a family friend that Blake found himself in the burgeoning field of residential land and community development, setting the stage for his future impact.

Building from the Ground Up

"I spent my first 13 years in the real estate business working for a community developer — and seven of those years were part of the project management team. The project — a 3,000-acre Planned Unit Development adjacent to Benicia, California, a community in the north San Francisco Bay Area. Real estate has always been a cyclical industry, and the homebuilders of those days — small, family-run 'Mom and Pop' operations — couldn't afford to keep enough land in inventory throughout the market cycle, so we offered a solution to address the inefficiencies. The job involved, at one time or another, raising both equity and debt capital to acquire the land parcels, taking the land through the entitlement, subdivision, and re-platting process, and preparing the resulting individual lots for third-party builders and developers. In one sense, I literally learned the real estate and land use business from 'the ground up.' And what I didn't learn on the job was gained from the evening real estate courses I took at the University of California at Berkeley."

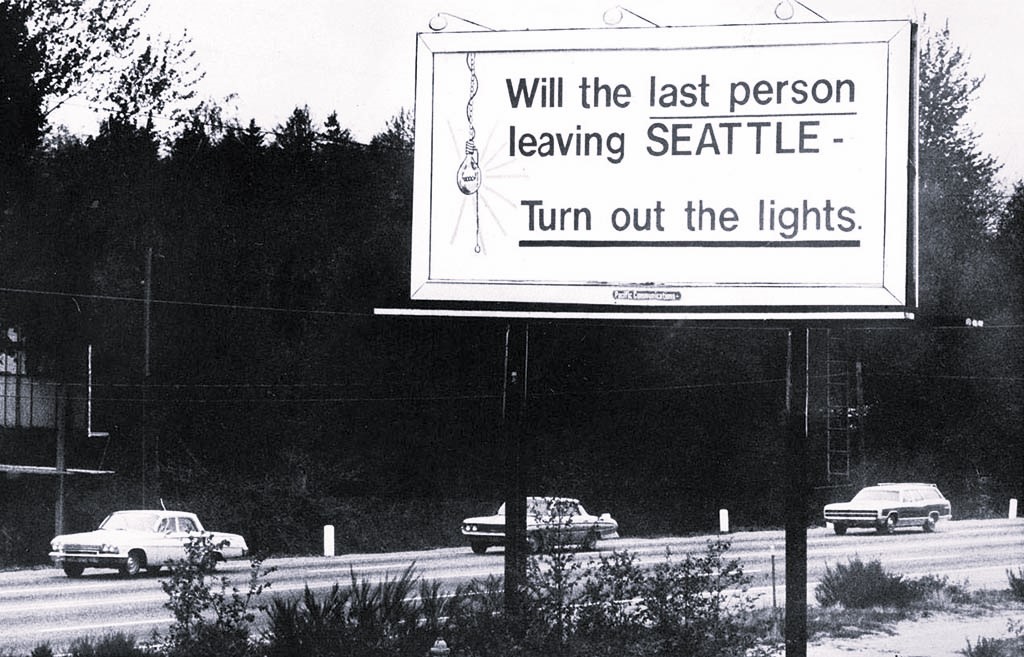

Returning to Seattle

Blake returned to Seattle in 1969, hoping to apply the skills he had refined over the last decade at his own commercial development company. In coming back home to the Emerald City, Blake expected to take part of what everyone believed to a perpetually booming real estate market as Seattle sought to take a place of prominence alongside other West Coast metropolitan areas like San Francisco and Los Angeles. However, the anticipated boom in the real estate market quickly turned into a devastating downturn — a sobering reminder of the unpredictable nature of the real estate market.

Facing Challenges

"The time period between when I formed my own development company and when I joined Frank Russell Company was about three years, That's all the time it required for me to go broke as a developer. The emphasis on the opportunity set for development then was cash flow, capital growth, and inflation protection — in reality, that meant having a high ratio debt, maximizing the tax shelter, and building equity through mortgage amortization. But then in 1970, the Boeing Company — by far the biggest employer in Greater Seattle area — laid off 50,000 employees almost overnight. The local real estate market went from prosperous and dynamic to severely depressed and the demand for commercial real estate evaporated. The only saving-grace for me: virtually every other developer was in the same situation. It was obviously time for me to change careers."

The First Real Estate Pension Consultant

In 1971, Blake joined Frank Russell Company (today's Russell Investments) to eventually head the firm's real estate consulting division at the behest of George Russell Jr., the company's CEO and pioneer of the institutional pension fund consulting industry. Tasked with addressing the pivotal question "Why real estate?" Blake’s leadership played a crucial role in positioning real estate as a significant asset class for institutional investors.

"We Understand Stocks and Bonds. But Why Real Estate?"

Under Blake's guidance, Frank Russell client's invested over $18 billion in real estate between 1971 and 1993. Blake's leadership at the helm of Frank Russell's inaugural real estate consultancy was fortuitously timed, as the circumstances of the 1970s provided what would turn out to be an attractive decade for real estate investment. The Employee Retirement Income Security Act (ERISA) — imposing stringent fiduciary duties on pension fund trustees — was enacted by Congress; the advent and acceptance of Modern Portfolio Theory was having a significant impact on how investment risk could best be managed from a portfolio perspective; and, stock and bond performance and global economic output had slumped under double digit inflation. Investment in the tax-advantaged asset class of real estate resonated with an influential cohort of institutional investors in desperate need of a superior inflation hedge.

Guiding the First Institutional Investors

As the first sponsors of open-end and closed-end real estate investment vehicles began soliciting institutional capital in the late 1960s and early 1970s, pension fund investors struggled with the informational deficit on real estate's role in a mixed-asset portfolio — in particular, a lack of any rigorous measure of historical measure to benchmark current investment opportunities against. Blake recognized institutional investors required a reliable, independently-vetted performance measure and associated database to support these real estate allocation decisions. Through Blake’s tireless drive, NCREIF was established as the institutional real estate investment industry’s repository of performance information and producer of its investment return measures, including the seminal NCREIF Property Index (NPI).

"Give Me a Real Estate Benchmark"

To Blake, the NPI was envisioned as the private real estate sector's answer to the S&P 500. But to create such an index, Blake and his colleagues had to convince a group of nascent real estate investment managers to put aside their competing interests and — for the common good of the industry — work together to respond to the performance measurement needs of those pension fund investors who were first among their peers to allocate money to private real estate. While reasonable on paper, many real estate managers were extremely skeptical of the intended results.

"And Get the Managers to Contribute Their Data"

The late George Peacock, head of real estate for Equitable Life Insurance Company and another real estate investment management icon, was among those Blake first pitched to the concept of a real estate performance index. As relayed by Blake in a 2018 presentation at University of Washington, College of Built Environments:

"George said, 'Why do I want to give you our data? It’s proprietary, we use it internally to give ourselves an edge in the market because we believe our information is probably more thorough and more reliable than many of our competitors.' When I raised the fact that (Frank Russell's) client base held significant clout in the marketplace, he scoffed and said 'I don’t need pension fund money. I’ve got all the money I need coming in through our life insurance sales, so we don’t need additional capital and we don’t need your index.' Well, markets changed as they usually do and the pension fund industry fully embraced the real estate index concept, compelling most of George's competitors to contribute their data in order to access pension fund capital. About a year and a half later from our first meeting, George and I had dinner in Seattle because he was on his way to Olympia to solicit the State of Washington's investment in his open-end real estate fund. Always a class act, George dubbed that dinner the night 'the eagle prevailed over the peacock' and we both toasted to the success of the NPI."

Transforming the Industry

Throughout the 1980s and 1990s, Blake’s relentless efforts were forefront in the development of solutions to real estate industry issues, including the need for improvement in valuations and reporting practices, better alignment of investment manager incentives with investor interests, improved investment vehicles, and enhanced liquidity through the trading of privately-held interests in what was then an unheard of secondary market. The results of Blake’s tireless pursuits: enormous progress within the institutional real estate investment management industry that has benefited investment managers, investors, and the myriads of real estate market stakeholders. No one in the institutional real estate market space has not been touched in some form by Blake’s pioneering efforts.

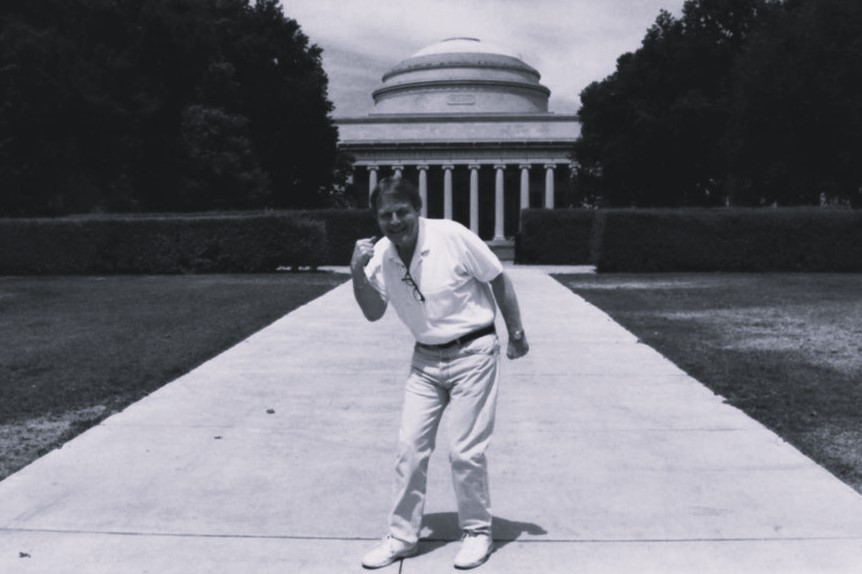

Mentoring the Next Generation

A significant aspect of Blake's professional persona has been his adept ability to bring together real estate's greatest academics and industry icons together in the pursuit of a more efficient real estate asset class. In 1994, he was appointed the Thomas G. Eastman Chair of the Massachusetts Institute of Technology Center for Real Estate. In this role, Blake was a dedicated educator who remained passionate about sharing his knowledge and experience with the next generation of real estate professionals. Many students and even more professional colleagues consider Blake to be their mentor and, for many, he served as the greatest influence in their professional careers. In 2001, Blake returned to once again lead NCREIF as its CEO, overseeing the trade association's continued work in the development of private real estate performance indices and innovative new research that continues to support the thesis that underpins the role of real estate in a mixed-asset class portfolio.

Celebrating an Industry Legend

Though Blake officially retired from NCREIF in 2008, he still remained active in giving back his knowledge and insights to the real estate community at large. He has served on the boards of several private and public real estate investment trusts, including Bentall Corporation, Cornerstone Properties, Metzler Realty Advisors, Mirvac Group, Pioneer Real Estate Shares, RREEF America REIT, Storage Trust Realty, and Talon Private Capital, and was a long-standing member of the Real Estate Advisory Committee of the New York State Teachers’ Retirement System (NYSTRS). He continued to serve as a NCREIF Ambassador until the early 2020s. His service across the myriad of organizations underscored his ongoing dedication to the real estate community.

Enduring Respect for an Icon

Blake Eagle’s career is a testament to visionary leadership and pioneering spirit. Blake has been honored throughout his career for his work and role in laying the foundations of a multi-trillion dollar real estate marketplace. Selected accolades include:

Awarded the Dr. James Graaskamp Award from the Pension Real Estate Association for his contributions to the body of knowledge in the field of institutional investment in real estate

Awarded Lifetime Achievement Awards from NCREIF, The Wharton Real Estate Center at the University of Pennsylvania, and Hoyt Institute

Inducted as a honorary member of the RPII and RPII Real Assets Education Foundation Board of Advisors

Subject matter expert invited to testify before The President's Commission on Housing, Department of Labor, and U.S. Senate Banking Committee

To honor Blake Eagle on his 90th birthday in 2023, the RPII Real Assets Education Foundation Center for Real Assets has been renamed the Blake Eagle Center for Real Assets in his tribute, celebrating his unwavering commitment to the real estate industry and the broader real assets sector. The Center is dedicated to fostering collaborative learning and advancing academic research to deepen the understanding of institutional investment in real assets. It provides vital resources to uphold best-in-class principles, delivering solutions that benefit both pension investors and real assets investment managers.

"As a mentor to many, Blake willingly shares his energy, his extensive knowledge, and his steadfast commitment to real estate education, all underpinned by unyielding ethics and professionalism," said Laura Huntington, CEO of Institutional Property Consultants and CEO, Real Property and Infrastructure Institute. "Blake’s life and legacy are a testament to what it means to be a mentor, leader, industry icon, and loyal friend. His dedication to bridging the academic and practical realms aligns seamlessly with the mission of the RPII Real Assets Education Foundation. The Center will carry forward Blake’s legacy by continuing to pursue research that supports institutional capital, ensuring it meets the needs of beneficiaries who rely on it for their financial security and best retirements."

If you would like to learn more about the Blake Eagle Center for Real Assets or are interested in supporting our work and mission, please contact us at info@rpii.org.

RPII Real Assets Education Foundation extends its appreciation to Blake Eagle and his friends and colleagues for their contributions to this article.